Owning unallocated gold is the most common form of gold investment in the world. What is the difference between “allocated” and “unallocated” gold, and why is it important to you as an investor?

The difference is significant, so it is important to know before making an investment in precious metals.

-

What is Allocated Gold?

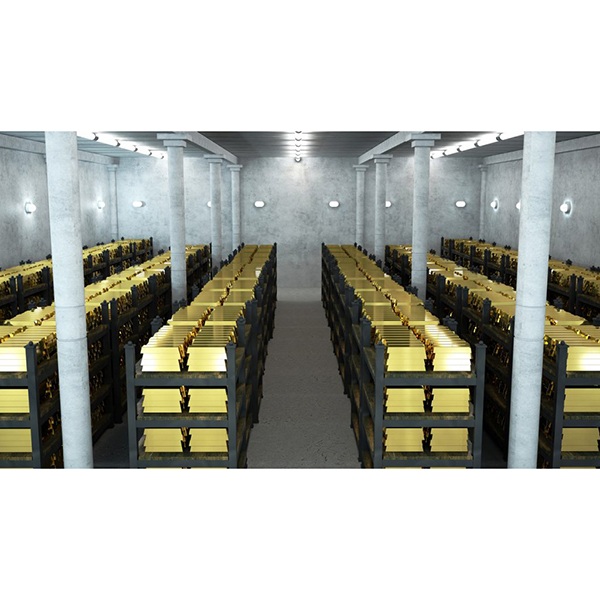

Allocated gold is physical gold that you can personally own. An account for allocated gold can be opened when a client requests that their gold be stored separately in either bar or coin form, along with a detailed account of the characteristics of the metal (for example, weights and assays).

The client is in full ownership of these metals, and has the ability to either store them at home or via a third party, such as in a vault. For allocated gold storage via a third party, there are usually additional storage fees involved that the client must cover.

Unallocated Gold

When deciding to buy gold from a bank, this will usually result in buying unallocated gold. In fact, about 95% of the world’s gold ownership is of unallocated gold. Unallocated gold is a bookkeeping device and means that the gold does not belong to you personally, but rather to unsecured creditors in a pool. Unallocated gold is a synonym for “gold accounts” and is formally considered a deposit, therefore belonging to the bank.

Unallocated gold accounts are usually measured in units of 1 fine ounce of gold.

Selling Physical Gold with Gold Investments

To begin selling your allocated gold online with Gold Investments, first sign up for our free Gold Club. From there, you will be able to contact us regarding what you would like to sell, and we will be able to offer a spot price premium. If you would like, we are also available to purchase your fine gold in person at our central London offices. If you would like to do so, please contact us to arrange an appointment.

If sending your gold via post, it must be sent the same day as the spot price was given in order to lock in that price. Please send your precious metals via Royal Mail Special Delivery in order for it to reach us as quickly as possible.

Please be aware that Royal Mail only insures packages up to £2,500, so it is best to make that the value of each parcel is not higher than this amount.

Contact Us

As a family owned business, customer service is our number one concern. While our goal is to process payment for mailed metals as quickly as possible, the fastest way to sell your gold bullion is to come into our offices in London personally, where we will value and buy your bullion on the same day at the best market price. To arrange an appointment, please call 0207 283 7752 or email [email protected].

Our offices are open weekdays from 9:00 am to 4:30 pm. Online trading is available 24 hours a day.